Market Intelligence & Commercial Real Estate

Main reason for that is land being fixed in the world, and as population grows it becomes scarce resource and its value goes up as a result of demand. So, investment in land or real estate was considered safest investment for the long period of time in the history. Even today, an investor who search for long term and safe investment opportunities, choose to buy land or real estate (buildings, house etc.) in the expectation of its being worth much more than today in the future.

In Azerbaijan also, when someone has savings and asks for investment advice, she/he will hear lots of real estate advice regarding which regions will appreciate in the future, where to buy, when to buy, what she/he can do after buying the property etc. We as a nation firmly believe that buying real estate, especially houses, and renting it, is a good of earning additional income.

However, this “tradition” is enhanced with relatively new concept – commercial real estate (CRE) both in our Azerbaijan and in the world. For those of you hearing it for the first time, commercial real estate is the type of property used for business processes, in other words, it is a real estate which consists of mainly office buildings, plazas, towers and provides workspaces for companies. As the number of companies increase day by day, commercial real estate becomes more attracting investment opportunity for investors than traditional real estate. But how this business is different than real estate? How firms search for office? What factors are analyzed when deciding on an office? How owners differentiate their real estate from others?

Similar to any company entering a new industry, one of the main analysis techniques to assess and understand the industry needs and requirements more deeply is Porter’s 5 forces. This analysis is very common in the business literature, however, does not require strong business background, just basic knowledge is enough. Who is Porter? Michael Porter is an academic famous for the theories related to business and economics. But main theory that makes him famous in the business world is this analysis. According to Porter, 5 main forces to analyze any business environment is power of suppliers, power of buyers, threat of substitution, threat of entrants and competitive. In the case of commercial real estate market, any commercial real estate owner, both current and potential (who plan to enter this market in the future) can easily apply this analysis to get the overall picture of this industry.

If you own commercial real estate you are a supplier of this service – renting office place, and you need to know how many suppliers besides you are there, what are the prices they are offering, how easy it is for customers – companies renting office to change their place, if it is easy to change an office place, then it means your power as a supplier is low, but power is in the hands of companies. Let’s suppose, you are production where you use heavy equipment, or your daily operations is depend on high technologies which requires lots of computers and network, in technical words, hardware and software – like Microsoft or Google, or you have a high number of workers then it is a significantly important decision for you to change your office place. Even if some things bother you regarding the service provided by your office landlord, you will consider high switching cost and not change your office. This situation gives the landlord power as supplier, as she/he knows that you will not easily leave the place and she/he can raise the rent, decrease the quality to cut costs etc.

However, if the number of commercial real estate who offer the same quality of service, cleanness, facilities, approximately same prices is low then, you as a supplier hold the power and dictate the rules. Additionally, how you keep up with your competitors is also deciding point in the success and profitability of your place. You need to keep in mind that no matter how good you are at your job, how perfect is your office place, how well your employees provide service, no one is irreplaceable. However, you need to do your best to attract and keep your customers with good customer relationship. To do that first thing is to know your competitors well, both direct and indirect. Direct rivals are the companies who provide the same service, rent of office place as you, so has substitutability risk. Indirect competitors are the ones that does similar job, maybe real estate companies, who not necessarily rent offices, but host events. You as commercial real estate owner, need to know both kind of competitors well enough to keep your costumers and stay/grow in the market.

Who are they, what are their strong and weak points, in which areas your company has a comparative advantage, what your company does better than competitors, what competitors do different than you and makes them more successful? By answering these questions, you as an owner will decrease the probability of losing the competition to your rivals. Besides current competitors, you need to think about potential entrants to the market you operate in and how their entrance will affect your business. If you operate in a commercial real estate market where buying an office place, finding customers that will rent your place and joining the competition is easy in terms of money and other resources required, then there is a high chance of new entrants interfering with your business and getting a market share. However, if finding a place to invest as commercial real estate and promoting yourself as an office rent place is difficult then, you do not need to worry about a new competitor joining the market easily.

For example, there may be monopoly or oligopoly where most plazas or other places for offices are in the hands of few large companies, and it is very hard for new companies or individual owners to earn money from this area. Final and in my opinion, most important aspect of market/industry analysis is competitive rivalry which helps to see number and strength of your competitors. Both of these factors are equally important for assessing rivalry. Because high number of competitors do not necessarily mean the competition is intense, as these competitors can be small and very low in market share which does not pose threat. However, having few but strong competitive which can be measured by ability to affect prices, indicates intense rivalry.

But why we look at our competition rather than focusing on our company strengths? Because no matter how good you operate and serve your customers, you will not survive unless forming an appropriate strategy according to the needs of market. For example, if your competitors are aggressively increase prices but you decide to keep office rentals the keep your customers, having a relatively low price than market average, will question the quality of your service. So, whatever your strategy as a company is, you need to adjust it to be able to compete with your rivals.

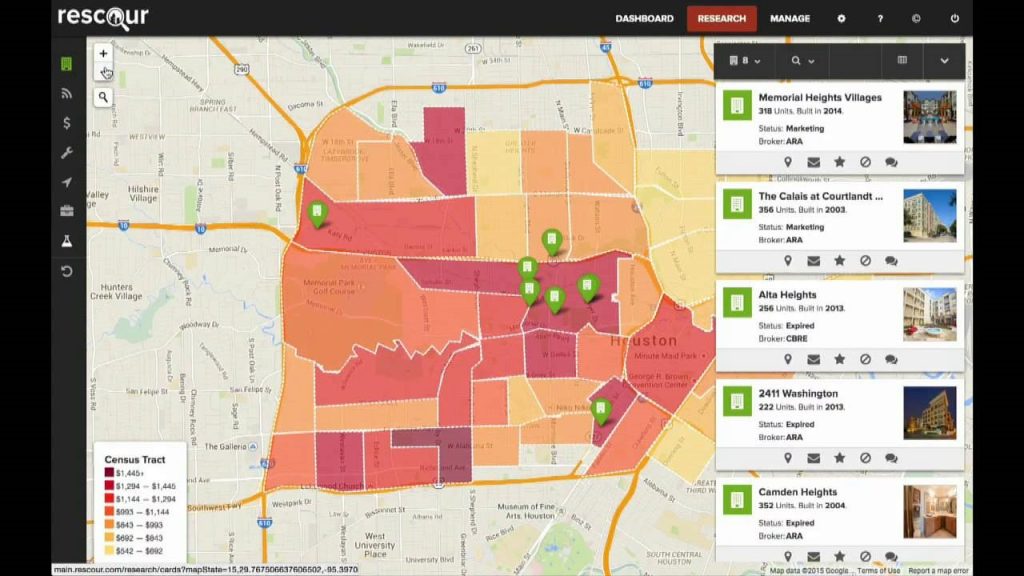

Most important point for industry and market analysis of the commercial real estate companies is the accuracy and up to date data. 21st century is most famous for the high pace of change in any area of business, so any, even minor change affecting businesses eventually influence commercial property business, as a result, companies who cannot keep up with this change get pushed out from market. But how can companies keep up with latest data and act upon it faster than competitors? Of course, the answer is technology. Different CRE companies apply different software to get the latest data and make decisions based on that. One of those popular software is REscour.

REscour is an enterprise application helping commercial real estate companies to gather data from different resources into one place, visualize this data in the form graphs, especially maps, helps to share all information among team members quickly. For example, by combining data from different regions of the country or the city, REscour creates heatmap where it shows which areas are on demand, so that companies can direct their resources to that areas.

Hence, it automates the process of gathering, sharing and decision making for commercial property companies. HERE you can visit their website and learn more about their business (maybe you would use it for you own commercial real estate business). In their website and Twitter which is very interesting and hugely recommended, they share latest news, article and tips for both commercial property owners and users (businesses).

One of the major partner and user of REscour service is Colliers International which is a international commercial real estate company operating in 68 countries with more than $3.5 billion in revenue. With the help of market intelligence tool REscour they manage to keep their leader position in commercial property business. If you visit their Twitter page you can see that applying technology to their operations, they are able to provide valuable insights for their partners and customers.

Efficiency and effectiveness are two of the most commonly used business terms and goal firms aim to achieve in their operations. Effectiveness is doing the right things, choosing the right place for an office, finding and employing the best fit workers for the jobs, offering the product/service to the potential customers. However, efficiency means the doing the things you do – production, hiring, marketing, accounting by using resources such as money, time, energy etc. in the most possible efficient way. In the case of office renting, firms first focus on effectiveness by looking for the best fit according their company image, needs, closeness to its partners or operations.

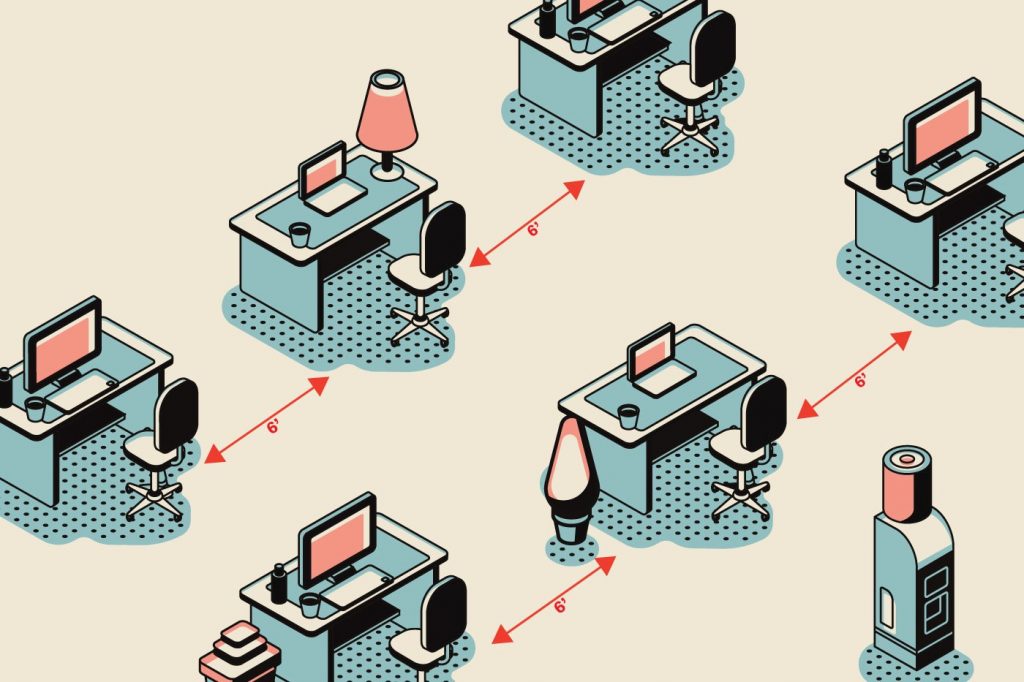

After they find the place appropriate to the needs and wants of the company, efficiency becomes main focus and management tries to answer the question of how to get most out of this office? How many employees do we have? How should we arrange the offices? Should we apply open office layout without any barriers to encourage more interaction? Or should we give each employee a separate place for more focused word? The answer is it depends. The efficiency and occupancy rate of the office place is highly depended on company style and what kind of working environment is needed for the employees in this firm to be most productive. Merely measuring how many people are in every meter square and making decisions on this basis may not give the company right information.

Why? Because every company is different. For the companies like Google that requires creative ability and interaction among employees, where looking at a room, you would see people who frequently talk to each other and work together on many projects, even on some aspects of their individual work, setting cubicles or giving each of them additional space to work is useless. This would be both waste of company resources and interfere with the work and decrease their productivity. Give them a couch and a notebook, and you will see it is enough.

On the other hand, if you force marketing and finance people to work in an open style office, you will see the immediate decrease in the performance of finance people, as their work requires deep focus (due to math related ) rather than interaction with each other. What we understand here is that, efficiency of the office place is based on quality, the question of how, rather than how many people to put in one room. The first and foremost question is what our employees needs to do their job. Does nature of their work require constant collaboration and share of ideas? Do they need isolated workspace with minimum distraction? Maybe for their call center (which is a lot of noise and distraction for other departments) soundproof windows?

After answering these questions, they can think about physical layout of the office place. How to locate each department? Which departments has the most interaction? How to decrease the motion during operations? Maybe not give each department separate place, but allocate some of them in one room to both decrease the amount of time spent for reaching each other and increase the pace of communication among departments. For example, if marketing and sales works closely, if they are in the same room, instead of sending an email which will cost both sender and receiver at least few minutes, person can approach, ask question and get answer in seconds. Many firms who values efficiency and would like to get most out of their 8-9 hours work, work on how to locate departments rather than how many people put in a room. This requires analyzing the company operations and know which steps is required for the job get done in the company. If for instance, any document needs to be approved by finance department before signed by CEO, finance needs to be located between other departments and CEO office.

Nonetheless, for the past 3-4 months, all these strategies, management techniques that aims to form the best working environment for employees are replaced only with one aim – healthy working environment. By healthy, I do not mean stress free, relaxed environment but psychical health – the notion COVID-19 made us all remember. As COVID-19 got officially labeled as pandemic, companies set aside all efficiency and effectiveness issues, but focused on how to continue their business without posing danger to employee’s lives. Many companies adopted home office style, but those who could not, whose business is based on personal contact with customers, adopted different strategies. Banks started accepting customers one by one, ASAN service (government body for documentation related issues) offered online queue to prevent crowds, office visits by employees were minimized to only urgent matters, the use of face masks is mandatory etc. What world is curious about right now is what will office places look like after pandemic ends? As business analysts call “what would be new normal?”.

Many people, including me, believe that open space working environment, close contact with coworkers will be history for a long period of time. Even if the danger goes away in reality, it will take time for people to get as friendly as before in their working environment.

Thousands of businesses are searching for office spaces every month. Get yours – at mAIndspace!